Medical school is a significant financial investment for any aspiring physician. According to Medscape’s 2023 Resident Salary and Debt Report, the average medical student graduates with around $200,000 in medical school debt.

The burden of this debt can be overwhelming, and physicians early in their careers employ various strategies to pay off medical school debt — from living as frugally as possible to participating in the Public Service Loan Forgiveness Program. But there’s a way for doctors to pay down their medical school debt and still have a fulfilling career in medicine: locum tenens.

Many physicians coming out of residency are finding locum tenens to be a great way to pay off medical school debt quickly while gaining experience in a variety of practice settings. Locums physicians typically earn more than their counterparts in permanent positions and have more control over how much they work — variables that can help speed up debt repayment.

Here’s how physicians have used locum tenens to their financial advantage.

Supplementing your income with locum tenens

After his first year as an emergency medicine physician, Dr. Ali Chaudhary met a fellow EM doctor who left a full-time job to work locums exclusively. With the extra income he was making working locum tenens, the doctor was able to pay off his medical school debt in just one year.

“That made me more aware of the idea of what locums actually was,” Dr. Chaudhary recalls. “Having known somebody who had done it before and explained to me how it works was one of the main reasons I started doing locums.”

Although he was still working his full-time job, he started taking locums assignments to supplement his income and pay off his student debt quicker.

“Eventually, I realized I had full flexibility and was getting paid more doing locums than I was at my full-time job, and I could work the same amount and make a lot more money or work less and make the same amount of money as I was at my job,” he says.

He came to realize working at his full-time job didn’t make any sense from a financial standpoint and left to work locums full time.

“I did love my full-time job from the perspective of having great colleagues to work with, great staff, and a great work environment but from a financial standpoint, it did not make sense.”

How this doctor paid off his student loans with locum tenens

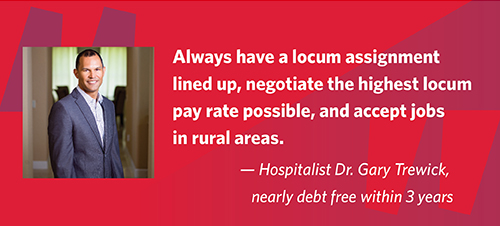

Dr. Gary Trewick finished his residency with over $500,000 in student loan debt. A hospitalist specializing in internal medicine, he’s managed to pay off nearly all of it quickly by working locum tenens and utilizing an aggressive payment strategy he learned from a neurosurgeon he worked with.

“He told me, ‘Pay down your debt as soon as possible. That’s the best strategy.’ I went all in, and I sacrificed just about everything,” Dr. Trewick says.

He works with multiple agencies to ensure he always has an assignment lined up for him, and he typically works about 20 days a month — a bit more than an average hospitalist. By maximizing the number of days he works, negotiating the highest pay rate possible, and accepting jobs in rural areas, he’s come very close to paying off his debt in just three years.

He admits that doing what he’s done takes a lot of determination, but he feels it’s worth it.

“Definitely pay off your loans as fast as possible,” he says. “Do locums. You may feel like you’re not ready, but if you can go with a full-time job, you can go with a locums job. If you’re doing it right, there will always be enough work.”

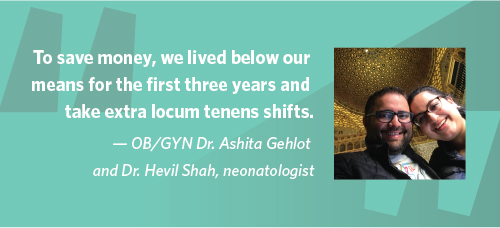

Paying off medical school debt by reducing spending

When you have two doctors in the family, paying off medical school debt becomes an even bigger priority. OB/GYN Dr. Ashita Gehlot and her husband Dr. Hevil Shah, a neonatologist, both completed medical school at the same time.

“Once medical school was over and both of us went into residency, then it became an eye opener,” says Dr. Gehlot.

They quickly realized that it could take them 20 to 30 years to pay off their loans if they didn’t come up with a plan. For them, this meant living below their means for the first three to five years.

“I think we’ve figured out a good balance for us, but it’s not like we’re missing out on the really fun things in life,” she shares.

When her husband’s fellowship took them from Georgia to Ohio, Dr. Gehlot began working locums assignments. In addition to being able to practice both obstetrics and gynecology, she was thankful for the opportunity to begin aggressively paying off her student debt. She’s also been able to take on extra shifts, which equates to higher pay than if she’d stayed in private practice.

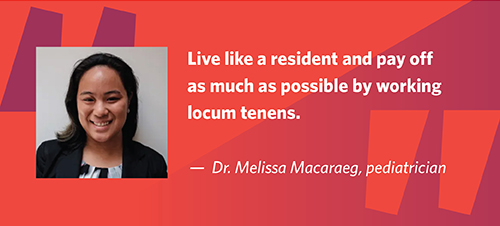

Living like a resident while working locum tenens

Dr. Melissa Macaraeg, a pediatrician, finished her residency in 2018 and has been working a combination of per diem and locums assignments in her home state of New York. She discovered locum tenens during residency and decided it would be a great way to gain some experience while she applied to fellowship programs.

The combination of traveling and the freedom to work wherever she wanted was a big draw, especially after experiencing burnout during residency.

“I was just exhausted. If I could earn more as a per diem and locums, then so be it. Paying off $265,000 is a lot of money but so is my mental health.”

To keep costs down, she adopted the advice of living like a resident and paying off as much of her debt as possible.

“I keep almost the same budget as I did in residency, and whatever is left over I put towards debt and loans,” she says.

Dr. Macaraeg took this advice a step further and moved back in with her parents, giving up her apartment in Brooklyn. “It doesn’t make sense for me to stay there with my traveling lifestyle,” she shares. “With that and not having to pay rent or the exorbitant prices of getting on the subway, it worked out for me.”

A practical side to locum tenens — financial freedom

Psychiatrist Dr. Chinenyenwa Onyemaechi enjoys the adventurous side of locums too, but her original motivation could hardly have been more practical. “I was really focused on my loans,” she says. “I didn’t want to be paying them for the rest of my life.” During her fellowship, she spent a lot of time thinking about the best way to tackle her debt. She’d overheard the phrase locum tenens, “but it wasn’t something really discussed as an option when I was in training,” she says.

Fortunately, Dr. Onyemaechi met a few “travelling” physicians just as she was finishing her fellowship. She didn’t have the full picture yet — it sounded more like moonlighting than anything else — but what she heard was enough to get her talking with a recruiter.

The more Dr. Onyemaechi learned, the more locum tenens felt like the right fit for her. Looking back, she firmly believes locums enabled her to pay off her loans much faster than a permanent position might have. She completed her fellowship in 2018 and says that by 2020 she was completely debt free.

“Many people look into other programs like the public service loan forgiveness and such,” she says. “But knowing myself, knowing that I enjoy working, and that I enjoy working hard — I decided to just spend a couple of years knocking it out. So that’s what I did — even faster than I anticipated.”

Are you ready to pay off your medical school debt?

Paying off debt doesn’t have to be stressful. Working locum tenens — full or part time — is an excellent option for physicians looking to pay down their medical school debt while still pursuing a fulfilling career in medicine.

Ready to learn more about locum tenens? Give us a call at 954.343.3050 or view today’s locum tenens job opportunities.